The consolidation software CoPlanner improves consolidation through a range of functions:

- Automation: Reduces manual intervention and minimizes errors.

- Integration: Seamless integration into existing IT systems for central data storage.

- Flexibility: Adaptation to company-specific requirements and processes.

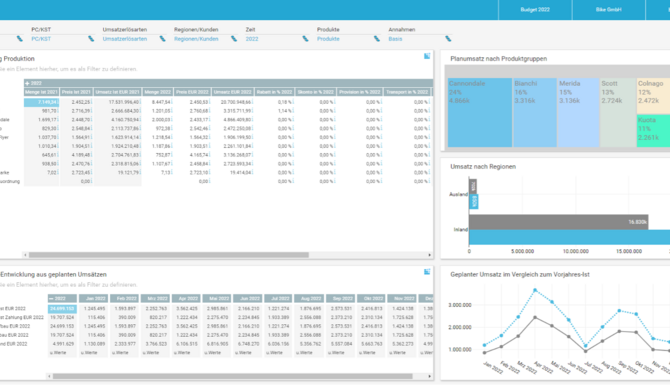

- Reporting: Automatic generation of consolidated financial reports according to individual and legal requirements.

- Compliance: Compliance with legal regulations and audit compliance through seamless logging and documentation.